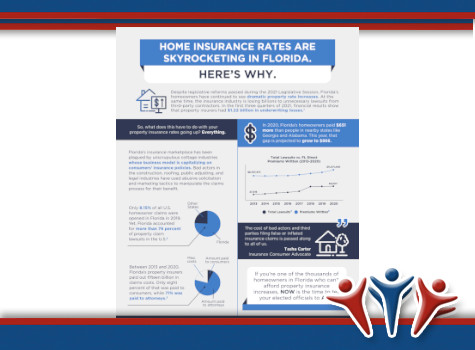

Yes, unfortunately it’s true. If you are one of the lucky ones that received a renewal offer from your insurance company, you might have been surprised when you saw the premium – and not in a good way. Last year in Florida, over 50,000 customers were dropped by their home insurance companies so, some homeowners might view any renewal as a win!

If we’ve learned nothing else in 2021, it’s this –THERE IS NO SUCH THING AS A FREE ROOF!

Roof repair fraud schemes are the big drive behind rising rates. Barry Gilway, president & CEO of Citizens Property Insurance Corp, said in an article published by the Insurance Journal in September of 2020, “The claims that we received, initially started out as being legitimate, solid claims. It’s very, very clear that when it comes to hurricane claims, people want to put the claim in, they want to put it in now because it is very real damage and they need a response to the damage,” Gilway said. “As time goes on, what you find is you’re getting more and more claims that are extremely questionable.” Many of the claims filed in 2020 were considered “door knocker” claims. Basically, homeowners being promised an insurance payout for damages unassociated with Hurricane Irma.

In addition, insurance litigation has had a big impact on Florida rates. In the first 3 quarters of 2021, Florida saw $1.2 billion in underwriting lawsuits. Majority of the lawsuit payouts are split 70%/30%. 70% to the attorney, not the homeowner. To learn more about what is happening with home insurance in Florida, we encourage you to click the links below.

If you’re frustrated and fed up with rising rates, you can take action. Click the top link below!